Get Started With

servzone

Overview

A limited liability partnership is a type of partnership firm that is more preferred by the entrepreneur. It is the easiest form of business structure with the benefit of limited liability. LLP registration gives partners the freedom to create a partnership structure where each partner's liability is limited to the amount they contribute to the business. Limited liability partnership firm registration means that if the partnership fails, creditors may not ask for the partner and personal property or income.

Limited Liability Partnership Firm?

LLP or limited liability partnership is a type of business structure that provides additional benefits than a partnership firm. It provides limited liability to its partners at very nominal compliance costs. In addition, partners of the firm can organize their internal structure like a partnership firm.

In short, LLP is a separate legal entity from its member which has the power to extend all its assets keeping in view the liabilities of the partners

limited. Hence, a Limited Liability Partnership is a hybrid of a company and a partnership firm.

Benefits

- Corporate Body

As per Section 3 of the Limited Liability Partnership An F firm is a corporate body under the LLP registration of the Act, 2008, which became effective from April 1, 2009. Indian Partnership Act 1932 is not applicable to LLP.

- Never Ending

A limited liability partnership firm gets the benefit of gradual succession and can continue its existence even after retirement, death, insanity of one or more related partners in the firm.

- Limited Liability

The most important feature of an LLP is the limited liability that all of its partners entertain which means their personal assets are secured and won and rsquot must be used to pay the firm's losses or debts. In addition, innocent partners of a limited liability partnership firm are not liable to pay for wrongdoings committed by another partner.

- Least Requirements

A person can start an LLP firm with only two partners, one of whom must be an Indian resident. The designated partner & nbsp; limited liability partnership firm may be either an individual or a corporate body. In addition, no specific capital is required to include limited liability partnership firm registration.

- The LLP Agreement

A contract is printed on a stamp paper and signed by all partners who define their roles and duties in the firm. It helps them in the decision making process.

- Easy Online Registration and E-filling

MCA has simplified LLP registration and made it an easy online process. Forms and documents are recorded electronically on the official MCA portal. A designated partner of a limited partnership firm has to obtain a DSC to sign these documents and forms.

- Easy Conversion

If a public or private company or a partnership firm decides to emerge as a limited liability partnership, they can easily be converted according to the provisions of the applicable Act.

- Business Management

The business is managed by the respective partners according to their roles and duties. The firm's designated partners are responsible for legal compliance.

- Profit Sharing Business

The profit is shared equally among all partners of a limited liability partnership firm. An LLP registration may not be included for a charitable purpose. Its purpose is to pursue business activities with the aim of making a profit.

Registration Procedure

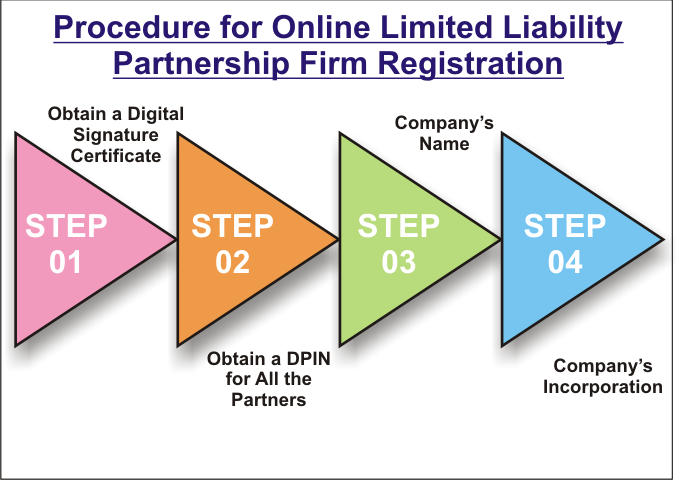

LLP registration is an easy online procedure that can be accomplished within 4 registration steps and 3 post incorporation steps.

Here is the step by step guide for Limited Liability Partnership firm Registration:

- Obtain a Digital Signature Certificate

The first step in the LLP registration process is to obtain a DSC for the firm's designated partner. DSC is important because LLP registration is an online process and all documents have to be digitally signed. The designated partner must obtain his / her DSC from a government recognized agency. Cost can vary from agency to agency. Be sure to obtain a Class 3 or Class 2 DSC certificate.

- Obtain a DPIN For All The Partners

The DPIN or Designated Identity Partner Number is mandatory for all designated partners of a limited liability partnership firm. Form DIR-3 is filed for obtaining DPIN. The applicant will have to attach a scanned copy of Aadhaar card and PAN card along with the form which should be signed by the Secretary of the company and rsquos or appointed by the Managing Director / CFO / CEO of the limited liability partnership firm. The director.

- Firm’s Name

The third step under LLP registration is a name for a limited liability partnership firm. For that, an applicant has to file LLP-RUN form. The name must be unique and non-invasive. For this, you can use the free name search facility available on the MCA portal. This system is quite helpful and provides a list of names similar to your firm and rsquos names. This will help you select a suitable name. An applicant can provide 2 names which will be further analyzed by the Registrar of Companies. In case of rejection / objection, you can submit your form 15 days after the rejection.

- Firm’s Incorporation

Once the name is reserved for the registration of a limited liability partnership firm you can proceed to the inclusion of your LLP. For this, you will have to file a form to include the Limited Liability Partnership of FiLLiP. It is filed with the Registrar of the firm of the respective state in which the registered office is located. Applicant must pay a special incorporation fee Annexure “A”.

All the documents and applications are duly checked by the authorities and if all goes well, incorporation certificate is issued.

Required Documents

| Documents required from the Partners | Documents required from the firm |

|

PAN Card |

Residential/ Address Proof |

|

Identity Proof |

DSC or Digital Signature Certificate |

|

Residence Proof |

|

|

Passport size Photographs |

|

|

Copy of Passport |

|

Partners Documents

- PAN Card/ Identity proof

All partners of the firm have to provide their PAN card at the time of LLP registration. It also serves as the primary identity proof.

- Residential proof

The concerned partners can submit any document including their passport, Aadhaar card, driving license or voter card. Ensure that the residential proof details match with the PAN card. If there is a spelling mistake, correct it before submitting.

- Passport size photographs

All partners of a limited liability partnership firm are required to provide their passport size photographs with a white background.

- Passport

It is mandatory for NRIs and foreign nationals to submit a copy of passport at the time of limited liability partnership firm registration. Passports should be notarized by the concerned authorities otherwise can be done by the Indian Embassy in the country concerned.

In addition, they must present a residential proof and if it is in a language other than English, attach a notarized or translation copy with the documents.

Members of a limited liability partnership firm should provide authentic and complete details in their documents.

Documents for the Firm

- Residential/ address proof

The applicant of a limited liability partnership firm is required to present the residential proof of registered office within 30 days of or after the limited liability partnership firm registration. If the registered office is on rent, a rent agreement has to be submitted with the NOC (No Objection Certificate).

An applicant can submit utility bills like electricity, telephone, gas bill for residential proof. Ensure that the bill is up-to-date and not older than two months and should include the full address of the premises concerned.

- DSC or Digital Signature Certificate

Any one of the designated partners of a limited liability partnership firm may opt for a DSC which will be required to sign all forms on the digital platform.

Types of Forms

| Name | Purpose |

| RUN-LLP |

A Form for the reservation of name for the firm. |

| FiLLiP |

LLP Incorporation |

| Form 5 |

A notice for the change of name. |

| Form 17 |

An application for the conversion of a firm into an LLP. |

| Form 18 |

An application for the conversion of a private or a public company into an LLP |

Total Fees and Time

It typically takes about 15 days to complete the entire process, from obtaining DSC to submitting an LLP agreement. The fees may vary; Here various government forms are estimated as follows:

| Forms | Estimated fees |

|

Digital Signature certificate |

Rs 1500 to Rs2000 depending upon the agency |

|

Director Identification number |

Rs 1000 |

|

Reserve Unique Name/ Name Reservation |

Rs. 200 |

|

LLP Incorporation |

As per the capital contribution: For the contribution up to Rs 1 lakh- Rs 500 For the contribution up to Rs 1 Lakh to Rs 5 lakh- Rs 2000 |

|

LLP Agreement |

As per the capital contribution and stamp duty charges of a different state. |

GST Registration

PVT. LTD. Company

Loan

Insurance